Rx Corner

Learn more about all things Pharmacy!

The Next Pharmacy Tsunami: Addressing the Risks Posed by Gene and Cell Therapy

If the growth of biological medications was the earthquake, gene therapy would be the tsunami that does the real damage. Since Harvoni and Sovaldi started making their way onto plans in the early teens a wave of concern was ushered in around specialty medications. I recall presenting “1% of claims was 25% of spend and would be 50% within 3 years” back in 2015/2016 – and sure enough that all came to fruition. Now the new wave is upon in Gene Therapy. To date, there have been only about 10 Cell or Gene Therapy medications launched in the United States. By the end of 2024, that number will breach 50. The average price tag of a Gene Therapy launched in the US today is $2,000,000. It is imperative for consultants to start thinking about good practices for managing Gene Therapy and Cell Therapy. This article covers what Gene Therapy and Cell Therapy are, the major risks to plan sponsors in the pipeline, and some best practices for preparing your clients for the incoming onslaught.

What are Cell and Gene Therapies?

Gene Therapy and Cell Therapy are similar treatments. Gene Therapy uses DNA to manipulate a patient’s cells for the treatment of inherited or acquired diseases whereas Cell Therapy is the infusion of whole cells to accomplish this end. CAR-T is a type of cell therapy where T-cells are collected from the body and sent to a manufacturing site where chimeric antigen receptors (CARs) are added to T-cells. Hence, CAR-T. These innovative approaches to therapy solve a myriad of rare genetic diseases and cancers that previously had no therapeutic solutions.

Make no mistake, these cell and gene therapies are nothing short of miraculous. But with an average cost exceeding $2,000,000 – it’s imperative that consultants strategize about pre-emptive measures they can take to protect their clients.

What Cell and Gene Therapies are Available Today?

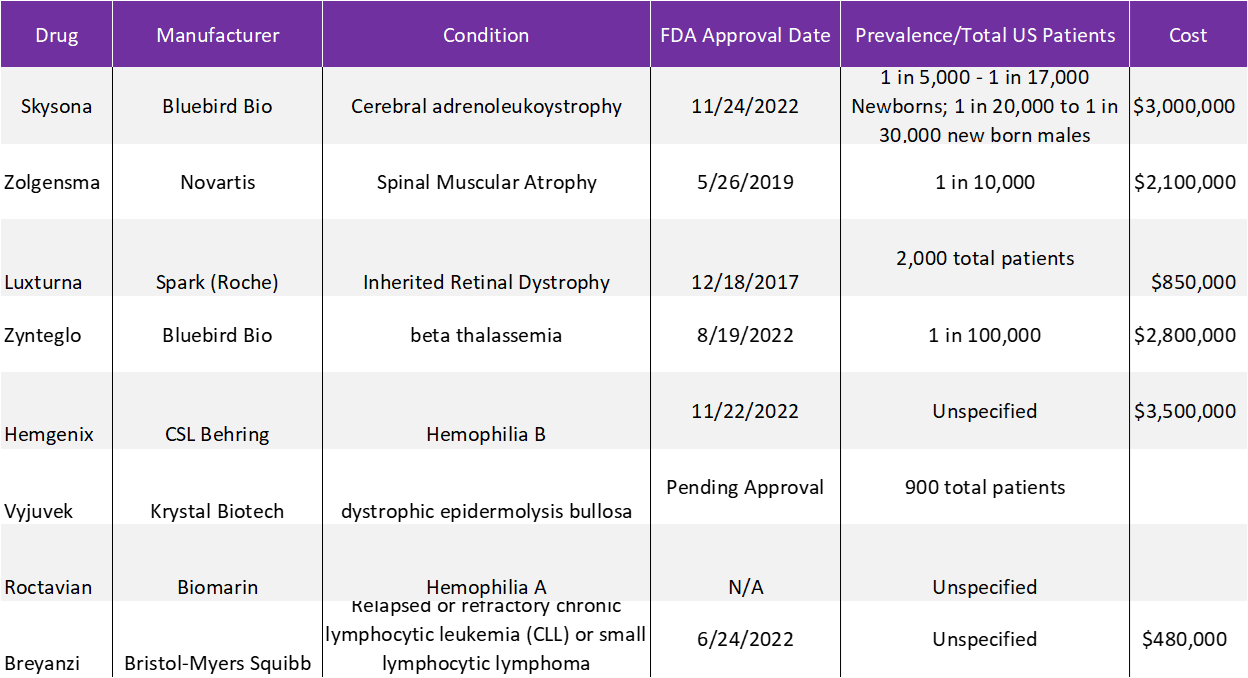

There are 27 FDA-approved Cell or Gene Therapies today. Here is a list of some of the most notable:

What’s the Concern For the Future?

McKinsey and Co. released a chart in September 2022 showing the potential growth of Gene Therapy and Cell Therapies by 2024 (see below). The rapid growth of therapies from 2021 to 2023 and 2024 is staggering. What’s more – there are over 300 Cell and Gene Therapies currently in development. While conditions such as inherited retinal dystrophy and beta thalassemia may seem exceedingly rare – it is the sum of all such rare diseases that should give consultants pause. There are over 7,000 rare “orphan” conditions in the United States impacting over 30 million patients. So the runway for Cell and Gene Therapies is long, the costs staggering and the probability uncomfortably high.

What’s My Risk?

The good news for most plan sponsors is that these treatments are typically one-and-done. A patient may receive treatment over the course of 30-90 days and in many instances will not need further treatment. This means no lasers on stop-loss policies or substantive risks to premiums. But there are two considerations we need to focus on:

- Preventing an Uncovered Claim

- Getting Value from the Treatment

Preventing Uncovered Claims:

Preventing uncovered claims in the Gene/Cell Therapy space is not all that different from a traditional setting. There are some things you can request that protect your plan:

Plan Mirroring

If a stop-loss has plan mirroring it just means that the Stop-Loss carrier agrees to cover whatever is in the plan document. If a claim is approved in accordance with the plan Summary Plan Description, there is no risk of an uncovered claim. Many times, a stop-loss policy can have exclusions that are listed separately in the policy which may not reflect the plan document. The most important in this context is the growing use of specific Gene Therapy and Cell Therapy exclusions. Consultants must keep a watchful eye on this approach. Tactically, a fly-by-night stop-loss carrier can offer much more competitive rates if they know they are not on the hook for the significant risks associated with this class.

No Lasering:

Lasers should not be much of a risk to a plan sponsor in the gene therapy and cell therapy space. That said, many Hemophilia A and B patients who are actively taking prophylaxis are going to be known risks to a stop-loss carrier. Should the patient join the plan mid-year before being scheduled for treatment for Hemgenix or Roctavian – it is a certainty they will be lasered for the upcoming year. No lasering provisions with max rate caps can be very valuable to employers as they move into the next few years. In fact, for employers with less than 500 employees, I believe No-Lasering provisions are almost a necessity given the uncertain risks.

Eligibility/Leave Management:

Coaching HR personnel at small to mid-size employers about properly handling FMLA and COBRA participants is perhaps one of the greatest risks in self-funding. A patient who should not be eligible for the plan due to the expiration of FMLA or COBRA that has been left on the plan and incurred a claim can easily turn into a coverage dispute. Making sure that HR personnel are keeping patients covered per their plan documents’ eligibility language is critical to avoiding this pitfall.

How Do I Ensure the Plan is Getting Value?

Addressing these high-cost therapies is going to require a paradigm shift in how plans consider coverage for high-cost medications. The FDA considers only efficacy and safety in its approval process. A recent JAMA article showed from 2017-2020 the FDA approved 206 new drugs of which 5 were not approved due to unfavorable benefit/risk assessments and 42 were not approved due to uncertainty of benefits or unacceptably high prices. Unfortunately, once a drug is FDA approved there are no pricing constraints on a manufacturer, unless there is a therapeutic substitute that PBM’s can use for negotiation purposes. It’s time for employers to start taking control over medications with excessive costs in their plan documents. This means building plan document language and coverage conditions that use independent evaluation of price as a determinant for coverage. A great resource for this is the Institute for Clinical and Economic Review (ICER). While some disagree with the methodology of ICER it is the only organization in the US that is an independent resource to assess cost/benefit analyses on high-cost medications.

Consider Hemophilia treatments recently launched and pending approval – Hemgenix and Roctavian respectively. In ICER’s Final Report, they found an evidence rating of B+ for Hemgenix vs. Factor prophylaxis and C++ for Roctavian again Factor Prophylaxis. This is mainly due to the fact that Roctavian’s impact has been shown to decline over time – meaning the benefits could be short-lived. In my opinion, until further research is available it would be advisable for a plan sponsor not to take such a significant risk to incur a multi-million dollar expense.

A strategy moving forward should be to incorporate ICER findings when available and not cover medications with less than a B or B+ rating. There are certainly shortcomings to this approach – mainly that ICER may not have a rating available for a medication as soon as it is released – or for years thereafter. A manufacturer may change the price of a medication to make it fit into the scope of ICER’s suggested ranges and adaptations should be made to address that. But it is clear to me that plan sponsors will need to take cost/benefit analysis into their own hands as the responsibility is not something the FDA takes into account.

Conclusion

In conclusion, the landscape of pharmacy benefits is rapidly evolving with the advent of gene and cell therapies, presenting both unprecedented opportunities and significant challenges for plan sponsors and consultants. The surge in gene therapy medications, with an average price tag exceeding $2,000,000, underscores the urgent need for proactive strategies to manage these innovative but high-cost treatments effectively. Consultants must guide their clients in understanding the risks posed by gene and cell therapies, including potential uncovered claims and the necessity of ensuring value from these treatments. Measures such as plan mirroring, no lasering provisions, and eligibility/leave management are crucial in mitigating risks and ensuring comprehensive coverage. Moreover, a paradigm shift towards independent evaluation of price and cost/benefit analysis, possibly leveraging resources like the Institute for Clinical and Economic Review (ICER), is essential for plan sponsors to navigate this complex landscape responsibly and sustainably. As the pharmacy industry braces for the impact of gene and cell therapies, informed decision-making and strategic planning will be paramount in safeguarding the financial health and well-being of plan sponsors and their beneficiaries.

Written by Jason Wenzke

President, Ringmaster Rx

Ringmaster Technologies