Rx Corner

Learn more about all things Pharmacy!

The Rebate Maze Part 1: How To Maximize Value and Minimize Client Risk

I’ve met a lot of consultants who get confused by drug rebates. Are they good? Are they bad? I can tell most don’t fully grasp the subject when I’m asked: What is the rebate on XYZ drug? The misunderstandings associated with rebates leads to bad decision making and a cascade of errors: clients choosing the wrong PBM, paying excess costs, taking additional risks, implementing counterproductive “cost savings” programs – all the way up to poorly constructed state and federal legislation. In this piece, I’ll cover how drug rebates work, when they’re good, when they’re bad and some consulting guidelines to help you shepherd your clients into arrangements that are well suited for their needs.

What are drug rebates?

Drug rebates are complicated, but probably the simplest explanation of a drug rebate is: It is a payment made by a drug manufacturer to a pharmacy benefit manager in exchange for access to a market and additional services provided by the PBM. The most significant drug rebates are formulary rebates and market share rebates. These are incentives paid by drug manufacturers to have placement on a PBM’s formulary and an incentive for driving a higher market share of the drug. Two things you absolutely must know: Drug rebates are at play almost exclusively in the brand drug world; and there is no single “drug rebate” on a drug. The rebate paid by a manufacturer to a PBM depends entirely on the bargaining power and contractual agreements of that particular PBM with that manufacturer (or with the PBM’s “rebate aggregator” which will be discussed later).

Insulin serves as a good example of the role of drug rebates. There are two main forms of analog insulin: Novolog (made by Novo Nordisk) and Humalog (made by Eli Lilly). These insulins are largely interchangeable and a PBM does not necessarily need both in its formulary. Hence, the PBM will put the two manufacturers in a bidding war for its membership to try to negotiate a large rebate and lower the net cost of the drug. Since PBM’s often have more than one formulary – they have contracts with both Eli Lilly and Novo Nordisk for both forms of insulin. However, for their “closed” formulary (a formulary with drug exclusions) they will drive greater market share and can have even better rebate terms with that manufacturer.

An important note: what you and I think of as an all-encompassing term, “rebates”, is broken into myriad different terms in PBM/Pharma contracts. There are market share rebates, formulary rebates, inflation protection credits, data fees, compliance reporting, etc. This is even further complicated if the PBM owns a specialty pharmacy which may have a litany of other service fees surrounding patient adherence and patient engagement.

When a consultant negotiates “rebates” with a PBM – they likely don’t care about the semantics of which “rebates” they are getting. The goal is to get all of them, or as close to all as possible. This is where transparency can be misleading – yes, it’s a HUGE bonus – but you will never fully know all the details of the various manufacturer revenue streams coming from manufacturers to a PBM despite your (and even sometimes the PBM’s) best effort. Your goal needs to be extracting as much as possible for your client – and this can really only be accomplished by conducting an RFP and creating a competitive bid process.

Why doesn’t the PBM just negotiate a lower cost at the point of sale?

Great question! Short answer – they can’t. At least not with precision. Many of these rebates we just discussed are performance based. Which means the PBM has to wait until the close of a quarter to share data with the manufacturer and determine the full amount of compensation they’ve earned.

In addition to that, if a PBM negotiated a lower list price every other PBM would be the beneficiary of their negotiations. Prices are set by drug manufacturers. They then sell to wholesalers at a modest discount. The wholesalers then markup the drugs and distribute them to retail pharmacies. When a patient walks in and fills a prescription, the PBM reimburses the pharmacy for the medication at a price that usually has a very minimal amount of profit (if not at a loss) for the pharmacy. If the PBM negotiated a lower list price on brand drugs, the amount the wholesaler and the pharmacy purchased the drug for would be lower – and the PBM would reimburse them a lower amount – however the same process would happen for every other patient and PBM and there would be no competitive advantage for the PBM that originally negotiated the discount. This is in fact why list prices have gone up. If the net cost of a drug is the same, the PBM will choose the one with a higher list price and larger rebate because it improves their differentiation in the market and creates an opportunity for them to improve profits. (This is quite fascinating – it puts Eli Lilly and Novo Nordisk in a prisoner’s dilemma where they both raise list prices despite it being a suboptimal decision for them…for you game theorists out there…).

Some PBM’s have built in “Point of Sale” rebates or “Reinvested Rebate” contracts to circumvent this problem. In these contracts the PBM reimburses the pharmacy the same amount we discussed before – however they bill the plan/patient an amount that more accurately reflects the cost of the drug net of the rebate. If you’re wondering why this practice hasn’t taken off, it’s because usually the PBM only “reinvests” a conservative share of the rebates and the net cost tends to be higher to the plan. Also, this practice ends up lowering the cost for a subset of high utilization patients on these medications – but has the net effect of increasing payroll deductions for all employees in order for the employer’s cost to remain neutral. In my experience, this is a trade-off employers have been unwilling to accept.

Why do we even need rebates?

Drug rebates are the mechanism PBM’s and the payers they represent use to create bargaining power against drug manufacturers and their patent protections. And its working. If you look at drug manufacturer earnings there is a phenomenon the pharmacy industry refers to as the “Gross to net bubble”. This is the fact that list prices for drugs are continually increasing (Gross cost), however the “gross profit” or net cost (Revenue – cost of goods sold) for drug manufacturers is actually declining. Adam Fein at Drug Channels Institute is an excellent resource to research this trend further.

The patent protections offered to drug manufacturers gives them extraordinary pricing power. With the ACA, plans are all but required to cover certain medications. Without competition – there is nothing constraining a drug manufacturer’s list prices. PBM’s aggregate the purchasing power of the payers (health plans and plan sponsors) to negotiate against these manufacturers. Just because there isn’t a direct competitor to a patented product does not mean there aren’t therapeutic substitutes – which is precisely what a PBM is often using to leverage pricing against a drug manufacturer. For example, in the inflammatory condition segment, there are dozens of anti-inflammatory medications that affect different mechanisms in the inflammatory cascade (think of hundreds of interlocking domino’s and a different drug is patented targeting each different domino – but regardless of which domino you hit – in many cases the domino’s all fall over). PBM’s leverage these therapeutic substitutes to threaten formulary exclusion status against a manufacturer which results in large rebates and a lower net cost to the plan.

If I Negotiate 100% Pass-Through Rebates Doesn’t That Solve For All This?

Ummmm…no. First, as we discussed, we don’t really know how much of the revenue stream a PBM receives is related to “rebates” and how much may be ancillary services. And we want all of the revenue stream (or as much as we can get) back to your clients. Second, to really get your arms around how rebates work – there’s a dark secret you need to know. Virtually every drug rebate passed down in the United States stems from 3 company’s: Zinc, Emisar and Ascent. Strange – you’ve never heard of them? These are GPO’s or Group Purchasing Organizations. Zinc is the GPO of CVS/Caremark; Emisar is the GPO of Optum/UHC and Ascent is the GPO of Cigna/Express Scripts. Regardless of who your PBM is, it is a near certainty that your rebate started with one of these three entities. As an example, Prime Therapeutics – the PBM owned by ~25 different BCBS organizations and the 4th largest PBM in the United States, uses Ascent as its GPO. And Prime Therapeutics may be the source of rebates for another PBM – who may be the source of rebates for yet another PBM. There are also entities called “rebate aggregators” – whose job it is to aggregate large individual employers and small PBM’s for the purposes of negotiating better rebate contracts with these large entities. So just because you have 100% pass-through rebate contracts doesn’t mean there isn’t a line of other PBM’s taking a cut of the drug rebates before they arrive at your client. Yes, the PBM you’re contracting with may pass through 100% of what they receive. But that doesn’t tell you how much you are receiving. This is why you still need to have minimum contract guarantees and why running a competitive bid will give you a good barometer on how well your PBM has negotiated its rebate contracts.

In defense of 100% pass-through contracts: all things being equal you ALWAYS want to choose the contract with greater of a minimum or 100% pass-through. It just so happens that all things are seldom equal. Some PBM’s have built a reputation on overperforming their rebate projections on pass-through contracts – and some have a reputation of underperforming. This should not be discounted when doing an evaluation – there is an art to all of this and relationships and reputation matter.

OK, I get it – rebates are good – and my PBM has a “Lowest Net Cost” formulary – so I’m set, right?

Rebates are not always a good thing. And few employers are on a truly “Lowest Net Cost” Formulary. Rebates can cause excess costs or excess volatility when they are the result of a drug that either A.) Shouldn’t have been filled in the first place or B.) Could have been a lower cost alternative.

There are conflicts of interest that arise from PBM management. I don’t believe it’s a grand conspiracy. But PBM’s are relied on to build clinical programs to help plan sponsors ensure drugs are clinically appropriate and necessary. They also negotiated drug rebates and may retain a share of these rebates as profit and the same goes with a spread pricing model on traditional drugs. They also own specialty pharmacies which are incentivized by manufacturers to ensure patient adherence. Adherence incentives, rebate retention and spread pricing create a disincentive and conflict for PBM’s to fulfill their duties as stewards of clinical necessity and appropriateness of care. Again, even if not malicious: how much does a business want to invest in lowering its revenue?

If your client is filling a medication that should never have been filled (many times this occurs with drugs used experimentally, off-label or drugs that should be prescribed by specialists that are being prescribed by non-specialists) then you are earning a rebate on a high list price drug that should be $0. Getting 50% off of something you never should have been billed for in the first place is not a good bargain.

The alternative is more nuanced. Sometimes a drug could have been a generic drug or therapeutic alternative. Sometimes this is a lapse in clinical criteria or a provider has fallen in love with the “latest and greatest” medication despite few clinical trials. Other times – there is a very nuanced trade-off that is taking place where the cost of the drug net of the drug rebate is less than the cost of the generic drug.

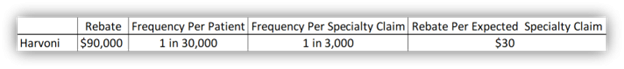

Harvoni is a great example. This is a hepatitis C cure (yes, cure) that has a list price close to $100k and the treatment lasts 90 days. Some important other stats: It impacts ~1 in 30,000 patients; there is a generic for this medication that costs closer to $10k as well as a host of therapeutic alternatives ranging from $30k – $75k. Virtually any other medication would make more sense from a list price standpoint. However, manufacturer’s that use this drug are likely receiving >$90k in rebates. This makes Harvoni the “Lowest Net Cost Alternative” on their formulary. But your client only is going to get billed $100k and their contract may only have a $3,000-$3,500 specialty drug rebate. So while this is the Lowest Net Cost drug for the PBM – once your client has a contract in place – it is definitely NOT the lowest net cost drug for them.

This won’t be easy – but follow the math to see where the artistry of this all lies: Consider that 1 claim equals ~$90,000 in rebates and its annual frequency is likely 1 claim spread over ~20 clients with ~30,000 total patients which – mathematically would fill ~300k scripts and ~3,000 of them would be specialty claims. So the overall specialty rebate the PBM can give you is $30 higher per claim ($90k/3,000 specialty claim). You have 19 clients that are getting a moderate win of an additional $30 per claim in their rebate guarantee – because they are being subsidized by the 1 client who is losing big by having a Harvoni claimant. This is why – at the PBM level – it is a lowest net cost formulary. But at an individual client level it is not. The main takeaway here is that these types of practices lead to significant volatility. For a 300-500 employee group, it could take over a decade for a Harvoni claim to net out even. But they may also be the beneficiary of going decades with inflated rebates and never having a Harvoni claimant. For a 10,000 or 15,000 life employer – the law of large numbers prevails and the numbers are more predictable.

Having Harvoni on formulary can inflate specialty rebate guarantees by $30 per claim. This is an estimated example.

With Humira coming off patent – this is going to be exceedingly difficult. There are biosimilars (generic in the specialty world) that have both high list price and high rebate and low list price and low rebate NDC’s. You are going to have a lot of questions to ask PBM’s – but that is another article.

How Do I Maximize Rebate Value and Avoid These Pitfalls?

There are several practices you can implement to drive better decision-making for clients:

- Market Check Your Contract Every Year: Yes, you read that right. I didn’t say run a full-blown RFP – but you need to negotiate your renewal and evaluate market rebates every single year to be sure you are in line with market rates. You, unfortunately, cannot just rely on “Pass-Through” or “Lowest Net Cost” formulary’s and rebate guarantees.

-

-

- Remember – All Things Being Equal – You Prefer Greater of a Minimum or 100% Contracts: 100% without minimums should be thrown out. High minimums is fine, just remember you can’t really have a lowest net cost formulary without language that has greater of a minimum of 100% (and even then it’s not a guarantee).

- Make Sure You Account for Exclusions From Rebate Guarantees: Part 2 will explicitly deal with this and can be found here: The Rebate Maze Part 2

-

- If Possible, Have Prior Authorizations Performed by an Independent Company: Some coalitions and PBM’s have the ability to push the clinical decision making to an independent third-party. This helps to alleviate the conflict of interest that exists between a PBM and the clinical criteria.

-

- Is the Clinical Third–Party Requesting Chart Notes on Specialty Drugs? Many providers know the clinical criteria and exactly what to tell a PBM to get a medication approved. PBM’s and vendors that request the provider supply chart-notes helps alleviate this problem. The trade-off is you do not want to hold up a low cost antidepressant over chart-notes. Focus on the high cost/high reward claims.

-

- Look for Critical Formulary Decisions: Harvoni is one example. Here are some other critical formulary decisions: Adderall XR, Synthroid, Gleevec, Xeloda, Zytiga, Tecfidera, Humira, Copaxone. These are all brand medications commonly preferred over their generic alternatives that may inflate rebate guarantees or the count of rebate eligible claims.

- Consider the Size of Your Client and Their Tolerance for Volatility: As I hope I made clear – the aforementioned formulary decisions aren’t necessarily deal-breakers – but understand that they may lead to more volatility which should be a greater consideration the smaller the employer.

- Never. Never Ever. Never Ever Ever? (Shout Out to Andre 3000) Look at Your Plan Costs Without Considering Drug Rebates: Most pharmacy reporting spits out gross drug cost pre-rebate. Many consultants and vendors use this to justify international sourcing, patient assistance, diabetes intervention and therapeutic interchange programs that have COST their clients money because they didn’t evaluate the true net cost of their drugs based on their clients contract. As an example, Otezla is ~$4,000 per fill. You may have a rebate of $3,500 per claim in your contract. Your net cost is $500. It does not make sense to put a patient through an assistance program and pay 25% of savings ($1,000) on an Otezla claim. Harvoni? Different story.

Written by Jason Wenzke

President, Ringmaster Rx

Ringmaster Technologies